· bill payment tracker notebook · 13 min read

Best Bill Payment Tracker Notebooks: Conquer Your Monthly expenses

Control your finances using the best bill payment tracker notebook. We researched the top options to help you stay organized and on top of your bills.

Paying your bills on time is essential for maintaining a good credit score and avoiding late fees. However, keeping track of all your bills can be a challenge. A bill payment tracker notebook can help you stay organized and on top of your finances. Here are a few of the best bill payment tracker notebooks on the market:

Overview

PROS

- Stay on top of bill payments with monthly payment checklists

- Ample space for noting due dates and tracking transactions

CONS

- Does not offer digital payment tracking

- May be less convenient for those who prefer digital bill management

The Bill Tracker Notebook is an invaluable tool for staying organized with your bills. Its monthly payment checklists provide a clear and structured way to keep track of due dates and transactions. The notebook's ample space allows for detailed notes and additional information, making it easy to manage even the most complex bill payments.

One potential drawback is the lack of digital payment tracking. However, for those who prefer the simplicity of a physical notebook, this drawback is easily overlooked. Overall, the Bill Tracker Notebook is a highly effective and affordable solution for managing and organizing your monthly bills, helping to keep you on top of payments and avoid late fees.

PROS

- Simple and clear instructions for loved ones.

- Can avoid probate costs in some cases.

CONS

- Can be time-consuming to set up.

- May not be appropriate for complex estates.

This helpful guide provides clear instructions for your loved ones to follow after you're gone. It can help to avoid probate costs and ensure that your final wishes are carried out. It can be time-consuming to set up, and may not be appropriate for complex estates. Overall, though, it is a valuable resource that helps ensure your loved ones are taken care of after you're gone.

I found this guide to be well-organized and easy to follow. It covers a wide range of topics, including funeral planning, estate planning, and financial planning. I would highly recommend this guide to anyone who is looking for a way to help their loved ones after they're gone.

PROS

- Streamlined bill tracking and management

- Organized space for recording due dates and payment status

- Helps avoid late fees and improve financial stability

CONS

- Requires manual input of bills

- May not be suitable for complex financial situations

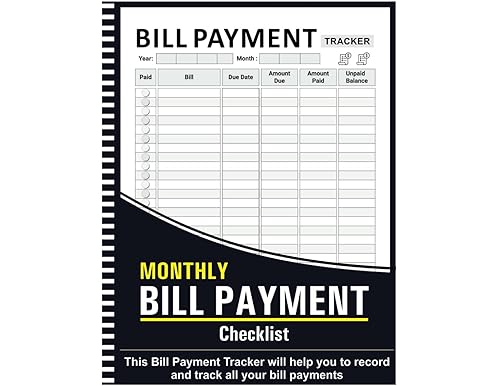

Introducing the Monthly Bill Payment Checklist - your ultimate solution to staying organized and on top of your bills. This comprehensive notebook provides a structured approach to bill tracking, empowering you to manage your finances with confidence.

Say goodbye to the stress and hassle of missed payments. Our meticulously designed tracker allows you to record all essential bill information, including due dates, payment amounts, and payment methods. With its clear layout and ample space, you'll have a clear overview of your financial obligations and can plan ahead to avoid any surprises. Whether you're a family managing household expenses or a professional overseeing business finances, this bill tracker is your go-to tool for staying organized and in control.

PROS

- Streamline bill payments with a dedicated tracking system.

- Stay organized with spiral binding and convenient back pocket.

- Keep financial records secure and easily accessible.

CONS

- May not be suitable for complex financial tracking.

- Size may not be convenient for carrying in small bags.

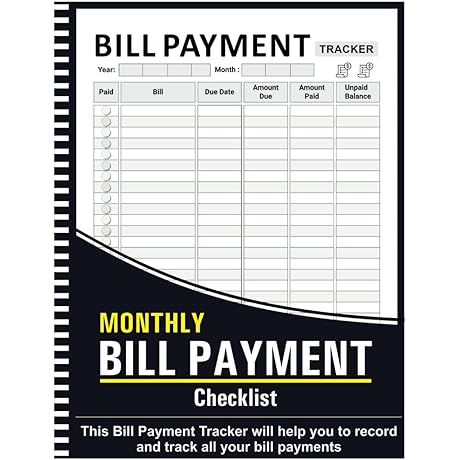

Introducing the Bill Payment Tracker Notebook, your ultimate solution for hassle-free bill management. This notebook seamlessly combines functionality and organization, making it easy to stay on top of your financial obligations. With its spiral binding, you can effortlessly flip through pages and locate bills due, while the back pocket provides a secure storage space for receipts and important documents. Whether you're managing home finances or tracking monthly expenses, this notebook helps you streamline the bill-paying process, ensuring timely payments and peace of mind.

Its compact size makes it easy to carry with you, so you can update payments on the go. The pre-formatted pages include sections for noting bill details, due dates, and payment statuses, fostering a structured approach to financial management. Say goodbye to the stress of missed payments and embrace the convenience of knowing your bills are taken care of, thanks to this indispensable Bill Payment Tracker Notebook.

PROS

- Keep track of all your bills in one convenient place.

- Easily manage and schedule payments, ensuring timely payments.

- Spiral binding and back pocket provide added convenience.

- Track expenses and stay within budget effectively.

CONS

- Not suitable for tracking complex financial transactions.

- May require additional space for notes and receipts.

Managing bills can be a hassle, but the Miru Bill Payment Tracker makes it a breeze. This comprehensive planner is designed to help you keep track of all your bills, ensuring you never miss a payment. Its spiral binding and back pocket provide added convenience, making it easy to carry and store. The tracker's simple layout allows for effortless bill management and scheduling, helping you stay on top of your finances. Whether you're an individual or a small business, the Miru Bill Payment Tracker is an indispensable tool for organizing your bills and staying within budget. Its user-friendly design and affordability make it an excellent choice for anyone looking to streamline their bill payment process.

We all know the feeling of dread when a stack of bills arrives in the mail. It can be overwhelming trying to keep track of due dates, payment amounts, and account numbers. But with the Miru Bill Payment Tracker, you can say goodbye to that stress. This handy A5 notebook is designed to help you organize and manage your bills effortlessly. Its spiral binding allows the notebook to lay flat for easy writing, and the back pocket provides a convenient place to store receipts and other important documents. The tracker also includes a monthly payment log and expense tracker, so you can keep tabs on your spending and avoid overdraft fees. If you're tired of the hassle of bill paying, the Miru Bill Payment Tracker is the perfect solution.

PROS

- Conveniently track all your monthly bills in one place

- Stay organized and ensure timely bill payments

- Detailed financial planner checklists for effective budgeting

CONS

- Not suitable for tracking complex business expenses

- Notebook format may not meet everyone's preference

Introducing the ultimate solution for managing your bills and expenses – the Bill Tracker Notebook. Designed to simplify your financial life, this comprehensive notebook is the key to staying organized and ensuring timely bill payments. With its dedicated space for tracking monthly bills, you'll never miss a due date again.

But that's not all! The Bill Tracker Notebook goes beyond mere bill tracking. Its detailed financial planner checklists empower you to budget effectively, plan for savings, and gain control over your finances. Whether you're looking to reduce expenses or simply streamline your financial management, this notebook is your trusted companion.

PROS

- Convenient and easy-to-use bill payment notebook for managing your finances

- Features multiple pockets and tabs for organizing bills, receipts, and other important documents

CONS

- Paper-based system may not be as convenient as digital options for some users

This bill payment tracker notebook is an excellent tool for staying organized and on top of your bills. With its multiple pockets and tabs, you can easily categorize and store bills, receipts, and other important documents. The A5 6-ring binder makes it easy to add or remove pages as needed, and the sturdy construction ensures that your records will be safe and secure.

Whether you're a senior looking for a simple way to manage your finances or a busy professional who needs to stay organized, this bill payment tracker notebook is a great option. It's easy to use, affordable, and can help you take control of your finances. It's the perfect solution for anyone who wants to pay their bills on time and stay organized without the hassle.

PROS

- Keep track of due dates and payments with ease

- Organize your bills monthly for better financial planning

- Premium notebook design for durability and style

CONS

- May not be suited for complex financial tracking systems

- Limited space for additional notes or details

Introducing the JUBTIC Bill Tracker Notebook, your ultimate financial management tool to streamline your bill-paying process. Its user-friendly design allows you to effortlessly track due dates, record payments, and organize your monthly expenses. Say goodbye to missed payments and financial stress with this comprehensive notebook.

The JUBTIC Bill Tracker Notebook features a thoughtfully crafted layout that caters to your budgeting needs. Its spacious compartments provide ample room to note down essential bill details, while the monthly organizer helps you stay on top of upcoming payments. The premium notebook's durable construction ensures that your financial records remain intact and easily accessible.

PROS

- Large size (9.25 x 7.5 inches) for ample note-taking space

- Multiple pockets and compartments for storing bills, receipts, and other important documents

- Clear and concise financial planning tools, including expense tracker and budget worksheets

- Sturdy construction and durable cover for long-lasting use

- Elegant dark green color adds a touch of sophistication to your financial planning routine

CONS

- May be too bulky for some users

- Not suitable for tracking complex financial data or managing multiple accounts

Introducing the GoGirl Budget Planner & Monthly Bill Organizer – your ultimate solution for stress-free budgeting and easy bill payment. This comprehensive financial planner is meticulously designed to help you stay organized and in control of your finances. Its convenient large size and multiple pockets make it easy to store all your essential bills, receipts, and notes in one place.

The intuitive design features clear expense trackers and budget worksheets, guiding you towards responsible financial planning. Whether you're looking to manage household expenses, personal finances, or even small business accounts, this versatile organizer has got you covered. With its durable construction and elegant dark green color, the GoGirl Budget Planner is not just functional but also a stylish addition to your financial planning routine. Say goodbye to missed due dates and financial stress, and embrace the peace of mind that comes with organized finances.

PROS

- Convenient 6 x 9-inch size, perfect for your desk or on the go

- Pastel color design adds a touch of style to your budgeting routine

CONS

- May not be suitable for tracking large or complex budgets

- Weekly format may not provide enough detail for some users

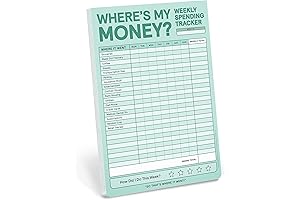

The Knock Knock Weekly Money Tracker Pad is a practical tool for keeping track of your weekly expenses. Its compact size and pastel color design make it easy to use and visually appealing. Each page features a simple layout that allows you to jot down your income, expenses, and balance for each day of the week, making it easy to stay organized and monitor your spending.

While the weekly format may be sufficient for basic budgeting, it may not provide enough detail for users who need to track complex financial transactions. Additionally, the tracker may not be suitable for tracking large or irregular expenses. Overall, the Knock Knock Weekly Money Tracker Pad is a convenient and user-friendly option for individuals looking to keep a close eye on their weekly spending habits.

In this article, we have explored several bill payment tracker notebooks to help you keep track of your finances. Whether you prefer a simple checklist or a more comprehensive planner, there is a notebook that can meet your needs. These notebooks can play a pivotal role in maintaining your budget and overall financial wellbeing. Remember to choose one that suits your specific requirements, and most importantly, stick to using it diligently.

Frequently Asked Questions

What is a bill payment tracker notebook?

A bill payment tracker notebook is a tool that helps you keep track of your bills and ensure they are paid on time. It can include features such as a monthly calendar, space to record bill details, and reminders for upcoming due dates.

How do I use a bill payment tracker notebook?

To effectively use a bill payment tracker notebook, consistently record each bill's due date, amount, and payment status. Utilize the notebook's calendar to plan ahead and set reminders to avoid missing payments. Furthermore, categorize expenses to identify areas for potential savings.

What are the benefits of using a bill payment tracker notebook?

A bill payment tracker notebook offers numerous benefits, including enhanced organization, reduced risk of late payments and penalties, simplified budgeting, and a clearer understanding of your spending patterns. It serves as a centralized hub for managing your financial obligations.

How much does a bill payment tracker notebook cost?

Bill payment tracker notebooks vary in price depending on their features and quality. Basic notebooks start around $5, while more elaborate options with premium materials and additional functionalities can cost up to $50 or more.

Where can I buy a bill payment tracker notebook?

Bill payment tracker notebooks are widely available at various retail stores, office supply outlets, and online marketplaces like Amazon. You can choose from a diverse range of designs, sizes, and features to suit your specific needs and preferences.